Mutual credit is an alternative way to pay for things, without conventional money.

Here’s an example of how it works:

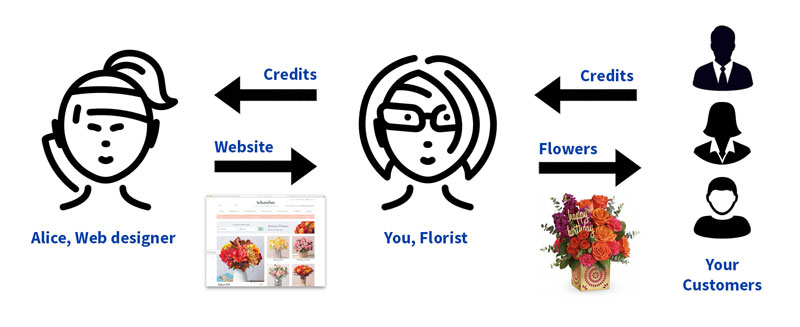

Imagine you run a florist – and you need an update to your website which is going to cost £500. But you only have £200 in your bank account. In order to pay for your new website you either need to take out a loan, or wait until you’ve saved up.

Mutual credit provides a way to pay for your new website straight away, and avoid paying interest too.

When you join a mutual credit network you offer your goods and services to the other members of network, at exactly the same price as you would charge in conventional money (£1 is equivalent to 1 Credit), and receive an interest free line of credit in return.

You offer £500 worth of flowers to other members of the network and are allocated £500 in credit. Your account balance starts at zero, but now you are able to order your website straight away.

You contact Alice, a web designer who is part of the network, who agrees to upgrade your website for £500 Credits. She designs the site and sends you a payment request, via her Open Credit Network account, for £500 in mutual credit.

You log in to your mutual credit account and accept the payment request. The funds are transferred and your balance goes down by £500 Credits and Alice’s balance goes up by £500 Credits. Your new website is up and running straight away, so you can take more orders for flowers.

Your mutual credit account is now minus £500 Credits, so you’ve reached your credit limit. But unlike a bank loan, or paying for the website on your credit card, you’re not being charged interest.

The next day, after your shiny new website goes live, 3 people order your £50 ‘Birthday Bouquet’ and pay you in mutual credit, so your mutual credit balance is now -£350. You can now place other orders for £150 worth of goods or services through the network, or keep selling to get your balance back to zero. As you sell more your balance will become positive.

As a member of the mutual credit network you can trade with any other member in Credits, growing your network of trusted trading partners. The more business join the network, the more effective it becomes for everyone.

Benefits of mutual credit:

Several of the advantages of mutual credit are explained in the above example:

- Free leads via enquiries from the directory – Alice got your enquiry via the directory, which she may not have done if she was not part of The Open Credit Network.

- Interest-free credit – You were able to order what you wanted straight away without taking out an expensive loan from the bank, or elsewhere.

- Improved cash flow – You were able to order what you wanted straight away without needing to wait to save up.

- Accept credit – Accepting payment in mutual credit makes your business more attractive, especially to other business with cash-flow issues. You may not have got the 3 ‘Birthday Bouquet’ orders if you only accepted conventional money.

- Preferred supplier status – If you’re the only business offering a specific product or service to the network you will be the first choice supplier for other businesses looking to pay in mutual credit.

- Trusted trading partners – Having traded with a business in mutual credit, got to know them a little and found you share an interest in ethical trading, which benefits local businesses rather than banks, you’ll be more likely to trade with them again – and other businesses will be more likely to trade with you again.

Wider economic benefits:

The wider economic benefits of using mutual credit are also significant. The more business members conduct through the network the stronger and more valuable the network becomes. Mutual credit creates an alternative, collaborative, cooperative economy.

The Open Credit Network is a cooperative, meaning it exists to serve the interests of its members, not to extract profits from them. Members have a say in how the network evolves, how fees are set and how credit limits are allocated so, by trading in mutual credit you are spreading the cooperative ethos.

Plus, by avoiding borrowing from, and using, banks you are encouraging an alternative to debt-based, bank-controlled money, developing economic resilience to financial crashes, avoiding wealth being siphoned from communities to tax havens and enabling trade even when money is scarce.

If you have any questions about how mutual credit works please get in touch.

You can browse the directory without being a member, sign up to the directory for free and start trading straight away, or find out more about how The Open Credit Network works.